HD Hyundai Robotics to raise $144.3 mn to bolster AI-powered robots

HD Hyundai Robotics Co., an industrial robot producer under South Korea’s shipbuilding and machinery giant HD Hyundai Co., will raise 200 bill...

HD Hyundai Robotics Co., an industrial robot producer under South Korea’s shipbuilding and machinery giant HD Hyundai Co., will raise 200 bill...

UCK Partners has sued a former senior employee who joined local rival Premier Partners in June, alleging he violated a non-compete clause, in what i...

Global private equity giant KKR & Co. Inc. is in advanced talks to acquire the waste management arm of SK Ecoplant Co., a South Korean construct...

IMM Private Equity Inc. is pursuing a separate sale of A’pieu, a color makeup brand under Able C&C Co., as the Seoul-based private equity ...

LG Chem Ltd. said on Friday it has finalized the sale of its water filter business to Seoul-based Glenwood Private Equity for 1.4 trillion won ($1 b...

The investment banking head of Morgan Stanley’s Seoul office is stepping down after overseeing a series of landmark deals over more than a dec...

The Korean Teachers’ Credit Union (KTCU), a retirement fund operator for South Korean teachers, has picked 10 local private equity firms to ru...

South Korea’s National Pension Service (NPS), the world’s third-largest pension fund, has yet to decide on a plan to select local extern...

South Korea’s LG Chem Ltd. has agreed to sell its water filter business – the world’s second-largest producer of reverse osmosis m...

South Korea’s Doosan Group has entered the bidding war for SK Siltron Co., the world’s third-largest manufacturer of semiconductor wafer...

US private equity firm Miri Capital Management LLC said on Tuesday it has raised its stake in STIC Investments Inc. to step up its shareholder activ...

South Korea’s Glenwood Private Equity Co. is set to increase a blind fund to 1.5 trillion won ($1 billion) as pension funds at home and abroad...

South Korea’s private equity firm VIG Partners’ buyout of minority stakes in Kakao Mobility Corp., the nation’s most popular taxi-...

Daol Private Equity has acquired Youngil Glass Industry Co., a South Korean manufacturer of glass containers, in a 65 billion won ($44.5 million) de...

The Korea Investment Corporation (KIC) on Monday explored investment opportunities in Europe’s middle-market private equity sector with other ...

Kyobo Life Insurance Co., South Korea’s third-largest life insurer, is in talks with some of its financial investors (FIs) to help them exit f...

Many companies, big and small, sell or buy affiliated units to raise funds or narrow their focus during economic downturns, and to fund expansion or...

South Korea’s Cactus Private Equity is set to acquire a stake in YM Tech Co., a Kosdaq-listed electric vehicle (EV) parts maker, for nearly 20...

IMM Private Equity has divested its remaining 1.38% stake in Woori Financial Group for 166.4 billion won ($115 million), exiting the South Korean fi...

Macquarie Asset Management has embarked on a process to sell off its 100% stake in South Korea’s third-largest industrial gas producer DIG Air...

Premier Partners and Praxis Capital are on track to raise 1 trillion won ($680 million) in their respective funds after the two South Korean private...

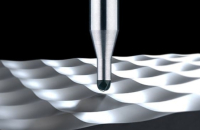

Seoul-based Kamur Private Equity has signed a definitive agreement to sell a majority stake in South Korean industrial cutting tool manufacturer JJ ...

An increasing number of South Korean companies are on the radar of private equity investors as the firms undergo digital transformation and generati...

Hyundai Mobis Co., the world’s fifth-largest auto parts maker, agreed to invest some 350 billion won ($256.9 million) in building electric veh...

Seoul-based private equity firm SkyLake Equity Partners has offered to buy the remaining shares of BusinessOn Communication Co., South Korea’s...

A private equity consortium seeks to buy a 100% stake in Koryo Nobel Explosives Co., South Korea’s No. 2 industrial explosives manufacturer, f...

LG CNS Co., the information technology service unit of South Korea’s LG Group, is gearing up for an initial public offering early next year, o...

A consortium of Eugene Private Equity and Korea Development Bank Private Equity will acquire 80% of South Korean vaccine maker Boryung Biopharma Co....

South Korean private equity investments declined last year for the first time since 2016 due to interest rate hikes, high inflation and the Korean w...

Affinity Equity Partners will buy a 100% stake in South Korea’s second-largest car leasing company SK Rent-a-Car Co. for 820 billion won ($591...