[RFP] POBA seeks US private debt fund managers for about $150 mn

The Public Officials Benefit Association (POBA) will select two to three US private debt fund houses to make senior secured, direct lending of around ...

The Public Officials Benefit Association (POBA) will select two to three US private debt fund houses to make senior secured, direct lending of around ...

Korea Scientists and Engineers Mutual-aid Association (SEMA) has decided to make its first allocation to global private debt funds by committing $...

Korea Post’s savings unit plans to select two global stock managers for exchange-traded fund (ETF) investment around the end of September, and four ot...

The Public Officials Benefit Association (POBA) will select two global private credit managers to invest around $200 million in mezzanine debt via sep...

Korea Post’s insurance unit is looking for two active-type Europe stock investment houses for a two-year investment period, according to its request f...

![[Survey] Direct lending, mezzanine at top of Korean LPs’ private debt strategies](/data/ked/image/2017/05/Private-debt.200x130.0.jpg)

South Korea’s leading asset owners are planning to expand private debt investment this year in pursuit of medium risks and medium returns, setti...

![[ASK 2017 SUMMIT Panel Talks] Korean LPs eye wider range of private debt](/data/ked/image/2017/05/LP-Panel2-1.200x130.0.jpg)

Private debt recently became one of the most favored asset classes for South Korean asset owners, alongside co-investments in overseas alternatives. ...

The Public Officials Benefit Association (POBA) has picked seven global private equity fund houses to invest $300 million in five different strategies...

![[ASK 2017 SUMMIT] NPS mulls private debt benchmark introduction](/data/ked/image/2017/05/NPS-CIO-Kang_ASK.200x130.0.jpg)

The National Pension Service (NPS) is considering introducing a benchmark for private debt in which it plans to increase investment, as the South Kore...

Korea Post's savings unit announced a plan on May 17 to invest up to $300 million in overseas private debt funds focusing on mezzanine and distresse...

The investment firm of South Korea’s Hana Financial Group has raised €44.2 million ($47 million) mostly from domestic life insurers through a private ...

The Military Mutual Aid Association’s (MMAA) former equity head Jae Dong Kim was installed this month as its first chief investment officer chosen fro...

![[RFP] Korea Post seeks global private equity FoF managers for $200 mn](/data/ked/image/2017/04/korea20post20logo.200x130.0.jpg)

Korea Post’s insurance unit is planning to commit about $100 million each to two multi-strategy global funds of funds (FoFs) employing primary, second...

The Government Employees Pension Service (GEPS) has awarded overseas private debt fund mandates for opportunistic strategies to Apollo Global Manageme...

![[Interview] ING Life Korea seeks equity investments in US, Europe core real estate](/data/ked/image/2017/03/Dohyun_Koo_ING_CIO.200x130.0.jpg)

ING Life Insurance Korea Ltd. sees core office buildings and infrastructure in the US and Europe remaining as attractive targets even in the periods o...

The Public Officials Benefit Association (POBA), a South Korean savings fund for government employees, has wrapped up its selection of five overseas p...

![[Interview] Lotte’s insurance arm eyes US infrastructure, private debts for low-risk alternatives](/data/ked/image/2017/03/Lotte-Insurance-CIO.200x130.0.jpg)

Lotte Non-Life Insurance Co. Ltd., a unit of South Korea’s retail giant Lotte Group, is looking to US infrastructure and private debt markets in Europ...

![[Interview] NongHyup Life eyes hedge fund, private equity secondary investments](/data/ked/image/2017/02/NH-Life-CIO.200x130.0.jpg)

NongHyup Life Insurance Co. Ltd., a unit of South Korea’s agricultural cooperative, will commit an additional 700 billion won ($620 mn) to overseas al...

South Korea’s Government Employees Pension Service (GEPS) will select two global private debt fund managers employing opportunistic strategies to inve...

South Korea’s Public Officials Benefit Association (POBA) is most likely to select global asset managers to invest about $200 million on aggregate in ...

South Korean institutional investors, including the Korean Scientists and Engineers Mutual-aid Association, Nonghyup Life Insurance Co. Ltd. and Lotte...

Gas-fired power plants in the pipeline in northeast U.S. states are expected to attract South Korean institutional investors in search of 5~6% annual ...

Korea Post’s savings arm has awarded offshore private debt mandates worth a combined $300 million to Guggenheim Partners, Park Square Capital and Part...

![[Interview] NPS eyes equity stakes in foreign infrastructure firms: CIO](/data/ked/image/2016/10/Kang-Myun-Wook.200x130.0.jpg)

South Korea’s National Pension Service (NPS) will chase equity stakes in foreign companies running power, harbor and road projects, as it is seeking t...

South Korea’s Construction Workers Mutual Aid Association (CWMA) will acquire 57 billion won ($51 million) worth of equity stakes in two domestic fund...

A former investment strategy head of the National Pension Service (NPS), Yoon-pyo Lee, will move to South Korea’s Truston Asset Management Co. Ltd. ne...

The Yellow Umbrella Mutual Aid is looking for stock management firms to invest a total of about 100 billion won ($88 million) and pick up to four fund...

Private debt products such as senior secured loans, collateralized loan obligation and mezzanine debt in the U.S. and European markets have become one...

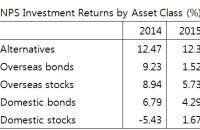

The National Pension Service’s (NPS) investment return dipped to 4.57% in 2015, but its performance outstripped those of other top five pension funds ...

![[Interview] Korea teachers’ fund CIO: interested in equity stake in asset managers’ holding firms](/data/ked/image/2016/05/강성석_한국교직원공제회_CIO_인터뷰7.200x130.0.jpg)

Korea Teachers’ Credit Union (KTCU), which manages 22 trillion won (about $18 billion) of assets, is considering an equity investment in holding compa...