Doosan Infracore issues $300 mn dollar bonds amid corporate restructuring

Doosan Infracore Co. Ltd., a Korean machinery manufacturer, has successfully issued dollar-denominated bonds worth $300 million despit...

Doosan Infracore Co. Ltd., a Korean machinery manufacturer, has successfully issued dollar-denominated bonds worth $300 million despit...

Yellow Umbrella Mutual Aid Fund, a savings arm for South Korea’s small-sized business owners, has committed $540 million to overseas debt funds ...

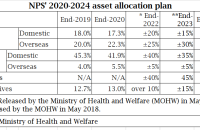

The National Pension Service (NPS) will more than double the proportion of overseas fixed-income investment to around 10% by the end of 2024 by when g...

![[ASK 2018 SUMMIT] NPS to boost direct alternative investment via overseas offices: CEO](/data/ked/image/2018/05/NPS-CEO.200x130.0.jpg)

The National Pension Service (NPS) will improve the role of its overseas offices in New York, London and Singapore to increase direct investment in al...

Korea Scientists and Engineers Mutual-aid Association (SEMA) will commit about 20 billion won ($18 million) to a fund of Morgan Stanley Energy Partner...

The Korea Teachers’ Pension on April 24 named its domestic alternative investment head Young-sin Jeong as new head of overseas alternative investments...

![[Interview] Hana Asset bets on retail demand for overseas real estate](/data/ked/image/2017/04/차문현-대표.200x130.0.jpg)

The asset management unit of South Korea’s Hana Financial Group is preparing to launch two new public funds investing in overseas real estate, betting...

The Public Officials Benefit Association (POBA) is screening investment proposals from overseas private equity fund managers to entrust a combined $30...

South Korea’s top financial regulator will cut reserve requirements by half for insurance firms’ cross-border infrastructure assets from as early as J...

Overseas alternative investments remained the best-performing segment for South Korea’s National Pension Service (NPS) for the third consecutive year ...

![[Interview] Mirae Asset Life eyes US power plants, buildings to boost overseas investment](/data/ked/image/2017/02/MiraeAssetLife_CIO2.200x130.0.jpg)

(This is the first in a series of interviews with CIOs of South Korea’s leading insurance companies in 2017.) Mirae Asset Life Insurance Co. Ltd., ...

The National Pension Service (NPS) has announced a plan to give its foreign offices more authority so that they can propose investment ideas directly ...

![[RFP] Korea Post seeks 3 management firms for overseas CLO investment](/data/ked/image/2016/08/korea_post_logo_detail.200x130.0.gif)

Korea Post’s savings unit announced a request for proposal on August 17 to select three asset management houses that will be in charge of setting up s...

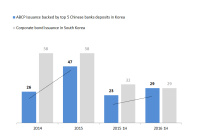

South Korean pension and savings funds are piling into short-term notes backed by time deposits at Chinese banks, lured by higher deposit rates from C...

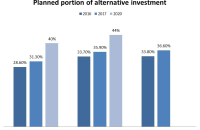

South Korea’s public pension funds, including the National Pension Service (NPS) and pension schemes for government officials and military personnel, ...

South Korean insurance companies have been raising investments in overseas investments by more than 50% since the start of this year and also consider...

A consortium of South Korean institutional investors, led by Mirae Asset Global Investments, has recently closed a deal worth about $245 million to bu...

Korea Fire Officials Credit Union, managing $520 million in assets, will boost its exposure to structured bonds and alternative assets in developed ma...

![[Interview] KIC CEO says seeks 10% returns from overseas project financing](/data/ked/image/2021/01/20/ked202101200045.200x130.0.jpg)

Korea Investment Corporation (KIC), South Korea’s sovereign wealth fund, may take part in project financing of overseas construction orders secu...

- On June 1, 2016, Korea Post’s insurance asset management bureau posts a request for proposal to invest in dollar-denominated sovereign bonds of emer...

- On May 26, Korea Post says plans to commit about $100 mln to 1 to 3 funds, respectively - Investment to be focused in North America or Europe thr...

- Proposal submission due by June 7, 2016; final selection set for July 2016 - To pick 2 firms for publicly-offered funds with minimum $300 mln AUM...

“Only free lunch in finance is diversification.”Korean institutional investors, who have seen their assets under management (AUM) snowball...

- GEPS to make 2nd commitment to global secondary PEF since 2014; investment size to triple - To pick 2 GPs by mid-June to commit $50 million, resp...

- Overseas portfolios seen to climb to over 35% by 2021 vs. 24.3% at end-2015 - Domestic portfolios seen to drop to 65% or below vs. 75.7% at end-2...

- To select 2~3 local asset managers or securities firms as GPs - If fails to bring in local GPs, it will open the door to foreign asset managers ...

- Planned investment in foreign blind PEFs in 2016 double last year’s allocation - To pick one asset manager in May to invest $220 million in Europ...

.s-chart { font-family: 'Noto Sans KR', sans-serif; margin-top: 30px; } .s-chart-txt-div { /*margin...