Korean banks fund alternative deals with $540 mn loans via KIC

South Korean banks have offered a combined $540 million in syndicated loans to fund overseas alternative investments, in which Korea Investment Corp...

South Korean banks have offered a combined $540 million in syndicated loans to fund overseas alternative investments, in which Korea Investment Corp...

The five leading banks in South Korea, including Kookmin and Shinhan, logged their first drop in net profit last year in five years, dented by shrin...

Hana Bank has become South Korea’s first commercial bank to issue foreign currency bonds at a negative yield, raising 500 million euros ($606 ...

Naver Corp., South Korea’s top online portal, is interested in buying Jeju Bank, named for and based on the country's largest island, to secur...

South Korean households and companies have taken out fresh loans worth 208 trillion won ($189 billion) from banks last year, pushing the outstanding...

South Korea's mobile-only bank has wrapped up its $920.5 million rights offering, placing the enterprise value at around 9.3 trillion won ($8.6 ...

Chief executives of banks operating in South Korea have picked the emergence of big technology companies and fintech startups in the credit market a...

Two leading South Korean banks – Shinhan and Hana – have provided a combined 47 million pounds ($63 million) in senior loans to finance ...

This is the first in our bi-weekly Deal briefs series, covering the latest M&A deals and key events in South Korea’s capital markets. We w...

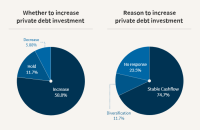

More than half of South Korea’s key asset owners, led by the National Pension Service, are inclined to expand overseas private debt investment i...

Hong Kong-based Anchor Equity Partners has agreed to invest 250 billion won ($226 million) to buy new shares in South Korea’s KakaoBank, shortly...

![[ASK2020] Private Debt: Playing Offense or Defense?](/data/ked/image/2020/10/30/ked202010300020.200x130.0.png)

StepStone is a leading private markets firm that oversees over US$296 billion of private capital allocations, including approximately US$67 bill...

![[ASK2020] The US middle market private credit opportunity](/data/ked/image/2020/10/30/ked202010300015.200x130.0.png)

Nuveen, the investment management arm of TIAA, is one of the world’s largest investment managers with over US$1 trillion in AUM as of 30 Ju...

![[ASK2020] Direct Lending (or Private Credit) in Asia](/data/ked/image/2020/10/30/ked202010300019.200x130.0.png)

Ares Management Corporation (NYSE: ARES) is a leading global alternative investment manager operating integrated businesses across Credit, Privat...

South Korea’s Kookmin Bank has issued $500 million in subordinated bonds as part of its efforts to expand loans for environmental, social and go...

![[ASK2020] The Opportunity in European Private Debt](/data/ked/image/2020/10/28/ked202010280005.200x130.0.png)

Park Square Capital is one of the world’s most established private debt firms, providing flexible financing solutions to high-quality and ...

![[ASK2020] Introduction to Australia’s Private Debt Market](/data/ked/image/2020/10/28/ked202010280006.200x130.0.png)

IFM Investors was established more than 25 years ago with the aim to protect and grow the retirement savings of pension fund members. IFM manage...

![[ASK2020] Trends in European Private Debt and Private Equity Post Covid19](/data/ked/image/2020/10/28/ked202010280008.200x130.0.png)

Tikehau Capital is an asset management and investment group with €25.7 billion of assets under management and shareholder equity of €2...

South Korea’s institutional investors, including pension funds, mutual aid associations and insurers, plan to increase the private debt portion ...

Shinhan Bank Vietnam Ltd., the Vietnamese subsidiary of Shinhan Bank, is close to becoming the top foreign bank in Vietnam thanks to its solid perform...

South Korea’s Police Mutual Aid Association (PMAA) has recently selected an opportunistic strategy fund for private debt investment as the $3 bi...

TPG will acquire a 2.7% stake in South Korea’s mobile banking app KakaoBank for 250 billion won ($222 million) ahead of an initial public offeri...

The Bank of Korea has left its policy rate unchanged at a record low of 0.5% as was widely expected, citing a slow economic recovery amid the ongoing ...

KakaoBank Corp., the mobile banking arm of South Korea’s online messaging app operator Kakao Corp., is planning an initial public offering next ...

Shinhan Bank has raised A$400 million ($285 million) in five-year bonds denominated in the Australian dollar to fund lending to pandemic-hit companies...

The Export-Import Bank of Korea (KEXIM) has issued euro-currency bonds worth $500 million at a negative interest rate, the bank said on Sept. 15, less...

Bond issuance by South Korean banks has risen to a record high as banks move to secure adequate capital to ride out any short-term liquidity disruptio...

The average capital adequacy ratio of South Korean banks declined in the April-June period for the third consecutive quarter, weighed by rising corpor...

The Bank of Korea revised down its 2020 growth forecast for the South Korean economy to a negative 1.3% from the previous 0.2% contraction on August 2...

Kookmin Bank has increased its stake in Bank Bukopin to become the largest shareholder in the medium-sized Indonesian lender, as it works to boost its...