private debt investors

Scope

Date

~

-

Korean Investors

Korean InvestorsKorean LPs favor direct lending for private debt investment

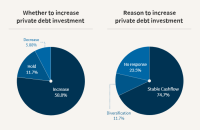

More than half of South Korea’s key asset owners, led by the National Pension Service, are inclined to expand overseas private debt investment i...

Nov 17, 2020 (Gmt+09:00)

-

Korean stock market

Korean stock marketMarket rally double-edged sword for fund managers as investors exit

The South Korean stock market’s recent rally is both a blessing and a curse for fund managers as investors are increasingly exiting their funds ...

Nov 17, 2020 (Gmt+09:00)

-

Korean stock market

Korean stock marketInvestors eye Goldilocks stock market in 2021; Biden, pandemic negatives

South Korea’s stock markets are expected to continue their uptrend into next year, fueled by aggressive foreign buying on the back of strong cor...

Nov 17, 2020 (Gmt+09:00)

-

Markets

MarketsSamsung shares hit historic high as foreign investors scoop up net $2.3 bn

Samsung Electronics Co. shares have soared to a historic high, driven by foreign investors scooping up a total net 2.6 trillion won ($2.3 billion) wor...

Nov 13, 2020 (Gmt+09:00)

-

Markets

MarketsForeign investors shift from growth stocks to net buy $3.5 bn in cyclicals

South Korea's stock market is seeing a shift in buying trends from foreign investors who are increasingly beefing up investments in cyclical stocks wh...

Nov 13, 2020 (Gmt+09:00)

-

Public finance

Public financeS. Korea's fiscal deficit tops $90 bn; public debt hits record high

South Korea's fiscal deficit in September has pushed the annual shortfall to over 100 trillion won ($89.6 billion) with public debt reaching an all-ti...

Nov 10, 2020 (Gmt+09:00)

-

Markets

MarketsSouth Korean investors ramp up US stock purchases

South Korean investors ramped up overseas stock purchases amid looming uncertainty surrounding the US Presidential Election during the first week of N...

Nov 09, 2020 (Gmt+09:00)

-

IPOs

IPOsKorean fried chicken brand draws over 1,000 investors in bookbuilding

Kyochon F&B, South Korea’s No. 1 fried chicken franchise operator, wrapped up a successful bookbuilding for institutional investors with bid...

Nov 02, 2020 (Gmt+09:00)

-

Stepstone

Stepstone[ASK2020] Private Debt: Playing Offense or Defense?

StepStone is a leading private markets firm that oversees over US$296 billion of private capital allocations, including approximately US$67 bill...

Oct 30, 2020 (Gmt+09:00)

-

Nuveen

Nuveen[ASK2020] The US middle market private credit opportunity

Nuveen, the investment management arm of TIAA, is one of the world’s largest investment managers with over US$1 trillion in AUM as of 30 Ju...

Oct 30, 2020 (Gmt+09:00)

-

Nuveen

Nuveen[ASK2020] Is now the right time to invest in UK real estate debt?

Nuveen, the investment management arm of TIAA, is one of the world’s largest investment managers with over US$1 trillion in AUM as of 30 J...

Oct 30, 2020 (Gmt+09:00)

-

Ares Management

Ares Management[ASK2020] Trends in Renewable Energy and Implications for Investors

Ares Management Corporation (NYSE: ARES) is a leading global alternative investment manager operating integrated businesses across Credit, Privat...

Oct 30, 2020 (Gmt+09:00)

-

Ares SSG Management

Ares SSG Management[ASK2020] Direct Lending (or Private Credit) in Asia

Ares Management Corporation (NYSE: ARES) is a leading global alternative investment manager operating integrated businesses across Credit, Privat...

Oct 30, 2020 (Gmt+09:00)

-

IFM Investors

IFM Investors[ASK2020] The outlook for US Infrastructure Debt

IFM Investors was established more than 25 years ago with the aim to protect and grow the retirement savings of pension fund members. IFM manage...

Oct 28, 2020 (Gmt+09:00)

-

Park Square

Park Square[ASK2020] The Opportunity in European Private Debt

Park Square Capital is one of the world’s most established private debt firms, providing flexible financing solutions to high-quality and ...

Oct 28, 2020 (Gmt+09:00)

-

IFM Investors

IFM Investors[ASK2020] Introduction to Australia’s Private Debt Market

IFM Investors was established more than 25 years ago with the aim to protect and grow the retirement savings of pension fund members. IFM manage...

Oct 28, 2020 (Gmt+09:00)

-

Hamilton Lane

Hamilton Lane[ASK2020] Why is co-investment an attractive tool for investors?

Hamilton Lane (NASDAQ: HLNE) is a leading alternative investment management firm providing innovative private markets solutions to sophisticated...

Oct 28, 2020 (Gmt+09:00)

-

Tikehau Capital

Tikehau Capital[ASK2020] Trends in European Private Debt and Private Equity Post Covid19

Tikehau Capital is an asset management and investment group with €25.7 billion of assets under management and shareholder equity of €2...

Oct 28, 2020 (Gmt+09:00)

-

Korean investors' survey

Korean investors' surveyKorean investors pick private debt as preferred asset class

South Korea’s institutional investors, including pension funds, mutual aid associations and insurers, plan to increase the private debt portion ...

Oct 27, 2020 (Gmt+09:00)

-

Interview

InterviewKorean police fund raises risk appetite for private debt

South Korea’s Police Mutual Aid Association (PMAA) has recently selected an opportunistic strategy fund for private debt investment as the $3 bi...

Oct 27, 2020 (Gmt+09:00)

-

Bond issues

Bond issuesKakao's exchangeable bond issue lures global investors

South Korea’s mobile platform giant Kakao Corp. is raising the price of shares to be converted from its exchangeable bond issue in Singapore on ...

Oct 22, 2020 (Gmt+09:00)

-

Proxy adviser

Proxy adviserGlass Lewis recommends LG Chem investors approve battery spin-off

Leading proxy adviser Glass Lewis has recommended that LG Chem Ltd. investors vote to approve the company’s plan to split off its battery busine...

Oct 15, 2020 (Gmt+09:00)

-

Private debt

Private debtBrookfield's debt fund to raise $610 mn from Korea

Brookfield Infrastructure Partners will collect around 700 billion won ($610 million) from South Korean institutional investors for its second credit ...

Oct 12, 2020 (Gmt+09:00)

-

Private debt

Private debtBrookfield set to raise $610 mn for new infrastructure debt fund: report

Brookfield Asset Management Inc. will collect around 700 billion won ($610 million) from South Korean institutional investors for its second infrastru...

Oct 11, 2020 (Gmt+09:00)

-

Real estate debt

Real estate debtKorean LPs commit over $94 mn to LaSalle’s $513 mn debt fund

South Korean pension and savings funds, including the Yellow Umbrella Mutual Aid Fund and the Korea Scientists and Engineers Mutual-aid Association (S...

Oct 10, 2020 (Gmt+09:00)

-

IPO

IPOBTS label Big Hit’s caginess upsets investors ahead of IPO bookbuilding

Big Hit Entertainment Co., home to the seven-member boy band BTS, is set to hold its first official IPO-related conference for South Korean institutio...

Sep 21, 2020 (Gmt+09:00)

language -

Markets

MarketsS. Korea’s big companies rattled by retail investors’ growing influence

South Korea’s big companies such as Samsung, LG and Hyundai often make shareholder-friendly moves to accommodate institutional investors, who fl...

Sep 18, 2020 (Gmt+09:00)

-

Restructuring

RestructuringKorean Air to lend $950 mn to US hotel unit for debt repayment

Korean Air Lines Co. will provide $950 million in loans to its fully owned US hotel operator which has $900 million in debt maturing this month, the c...

Sep 17, 2020 (Gmt+09:00)

-

Tech

TechKorea’s big data companies eye IPOs as investors flush with cash

Tech investors are set to be deluged with initial public offerings as South Korea’s big data companies are pushing to list their shares amid a d...

Sep 15, 2020 (Gmt+09:00)

-

Renewable Energy

Renewable EnergyHana Financial to fund Australia solar power project with $146 mn senior debts

Hana Financial Investment Co. Ltd. has secured A$200 million ($146 million) in senior loans to finance A$320 million solar power project in Australia ...

Sep 14, 2020 (Gmt+09:00)

Latest News

- 1 Want to look beautiful? – Here’s the 'Made In Korea' mask pack

- 2 LG Chem closes $1 bn water filter division sale to Glenwood PE

- 3 Hyundai Motor-backed Motional names AI veteran Laura Major as CEO

- 4 President Lee: Businesses at center of policy priorities for economic growth

- 5 Samsung supplies HBM3E to AMD’s new accelerators