private equity firm

Scope

Date

~

-

Project financing

Project financingKEXIM to finance Korean firms' Mozambique LNG plant project

The Export-Import Bank of Korea (KEXIM) will provide $500 million in project financing to South Korean companies for their $550 million construction...

Dec 10, 2020 (Gmt+09:00)

-

Energy

EnergyKorean biotech firm produces krill oil with top phospholipid content

South Korea’s biotechnology firm Biocorp Co. has produced krill oil containing 61% phospholipids, the highest level in the world, and has begu...

Dec 10, 2020 (Gmt+09:00)

-

Venture Capital

Venture CapitalKDB backs $100 mn SE Asia fund of Korean, Chinese VC firms

South Korean venture capital firm SV Investment Corp, together with China’s Shenzhen Capital Group, will raise $100 million in the Korean VC's...

Dec 09, 2020 (Gmt+09:00)

-

In vitro diagnostics

In vitro diagnosticsSamsung hands over diagnostics business to local bio firm

Samsung Electronics Co. has agreed to hand over the business rights for its in vitro diagnostics (IVD) unit to a South Korean bio company as part ...

Dec 07, 2020 (Gmt+09:00)

-

Private equity

Private equityMBK looks to exit China’s Apex Logistics for $1 bn

MBK Partners has begun the process to sell Apex Logistics, China’s leading air freight company, for about 10 times the amount of its investmen...

Dec 04, 2020 (Gmt+09:00)

language -

Private equity

Private equityMBK buys $228 mn stake in China’s No. 1 car rental firm

MBK Partners has now become the second-largest shareholder in both of China’s two biggest rental car companies after purchasing a 20.86% stake...

Dec 03, 2020 (Gmt+09:00)

language -

Mergers & Acquisitions

Mergers & AcquisitionsIMM Private Equity to set up operation-focused unit

This is the first in our bi-weekly Deal briefs series, covering the latest M&A deals and key events in South Korea’s capital markets. We w...

Dec 01, 2020 (Gmt+09:00)

-

Energy

EnergySaudi crown prince to be top shareholder of Seoul-listed gaming firm

The Crown Prince of Saudi Arabia Mohammed bin Salman has agreed to buy 240 billion won ($217 million) worth of shares in the South Korea-listed game...

Nov 27, 2020 (Gmt+09:00)

-

Korean Investors

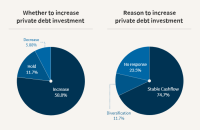

Korean InvestorsKorean LPs favor direct lending for private debt investment

More than half of South Korea’s key asset owners, led by the National Pension Service, are inclined to expand overseas private debt investment i...

Nov 17, 2020 (Gmt+09:00)

-

Pre-IPOs

Pre-IPOsAnchor Equity, TPG invest $500 mn in Korean mobile banking app

Hong Kong-based Anchor Equity Partners has agreed to invest 250 billion won ($226 million) to buy new shares in South Korea’s KakaoBank, shortly...

Nov 17, 2020 (Gmt+09:00)

-

Logistics

LogisticsS. Korea's shipping firms grapple with container shortages

Growing shipping volumes and surging sea freight rates are wreaking havoc on South Korea's shipping companies, reeling from a dire shortage of contain...

Nov 12, 2020 (Gmt+09:00)

-

Logistics

LogisticsKorean firms face triple whammy of soaring KRW, freight rates, Biden

South Korea’s major companies are facing a triple whammy of challenges — a stronger Korean currency, soaring seaborne and air freight rate...

Nov 08, 2020 (Gmt+09:00)

language -

Bio

BioSamsung aims to be No. 1 bio contract development, research firm

Samsung Biologics Co. has become the world’s No. 1 contract manufacturing organization (CMO) this year and aims to also lead both the contract d...

Oct 30, 2020 (Gmt+09:00)

-

Stepstone

Stepstone[ASK2020] Private Debt: Playing Offense or Defense?

StepStone is a leading private markets firm that oversees over US$296 billion of private capital allocations, including approximately US$67 bill...

Oct 30, 2020 (Gmt+09:00)

-

Nuveen

Nuveen[ASK2020] The US middle market private credit opportunity

Nuveen, the investment management arm of TIAA, is one of the world’s largest investment managers with over US$1 trillion in AUM as of 30 Ju...

Oct 30, 2020 (Gmt+09:00)

-

Ares SSG Management

Ares SSG Management[ASK2020] Direct Lending (or Private Credit) in Asia

Ares Management Corporation (NYSE: ARES) is a leading global alternative investment manager operating integrated businesses across Credit, Privat...

Oct 30, 2020 (Gmt+09:00)

-

Park Square

Park Square[ASK2020] The Opportunity in European Private Debt

Park Square Capital is one of the world’s most established private debt firms, providing flexible financing solutions to high-quality and ...

Oct 28, 2020 (Gmt+09:00)

-

IFM Investors

IFM Investors[ASK2020] Introduction to Australia’s Private Debt Market

IFM Investors was established more than 25 years ago with the aim to protect and grow the retirement savings of pension fund members. IFM manage...

Oct 28, 2020 (Gmt+09:00)

-

Tikehau Capital

Tikehau Capital[ASK2020] Trends in European Private Debt and Private Equity Post Covid19

Tikehau Capital is an asset management and investment group with €25.7 billion of assets under management and shareholder equity of €2...

Oct 28, 2020 (Gmt+09:00)

-

Korean investors' survey

Korean investors' surveyKorean investors pick private debt as preferred asset class

South Korea’s institutional investors, including pension funds, mutual aid associations and insurers, plan to increase the private debt portion ...

Oct 27, 2020 (Gmt+09:00)

-

Interview

InterviewKorean police fund raises risk appetite for private debt

South Korea’s Police Mutual Aid Association (PMAA) has recently selected an opportunistic strategy fund for private debt investment as the $3 bi...

Oct 27, 2020 (Gmt+09:00)

-

Brokerage firms at odds on Hyundai Glovis outlook

Brokerage firms are showing sharp divide in the share price outlook of Hyundai Glovis Co., a logistics unit of the Hyundai Automotive Group. The optim...

Oct 26, 2020 (Gmt+09:00)

-

IPOs

IPOsFirms vie to become Krafton's $883 mn IPO manager

A competitive lineup of securities firms gathered at game developer Krafton Inc.'s office building in Pangyo, Gyeonggi province on Oct. 21 to pitch fo...

Oct 21, 2020 (Gmt+09:00)

-

Global brand

Global brandSamsung overtakes Coca-Cola in brand value; highest among Asian firms

Samsung Electronics Co.’s global brand has risen to the highest ranking among Asian companies, as the South Korean tech giant overtook Coca-Cola...

Oct 20, 2020 (Gmt+09:00)

language -

Waste management

Waste managementKKR buys $386 mn stake in Korean sewage disposal firm

KKR & Co. has purchased a combined 440.8 billion won ($386 million) worth of shares in TSK Corp., a leading South Korean sewage and wastewater tre...

Oct 19, 2020 (Gmt+09:00)

-

Pension funds

Pension funds[Q&A] KTCU sees handsome returns from equities, M&A funding

The following is the full transcript of The Korea Economic Daily's interview with Korean Teachers’ Credit Union’s (KTCU) Chief Investment ...

Oct 13, 2020 (Gmt+09:00)

-

Interview

InterviewKorean teachers’ fund keen on equities, M&A deals

The Korean Teachers’ Credit Union (KTCU), a $29 billion savings fund, will increase its exposure to equities markets and M&A financing deals...

Oct 13, 2020 (Gmt+09:00)

-

Automobiles

AutomobilesHyundai Mobis to invest $25 mn in UK vehicle smart display firm

Hyundai Mobis Co., South Korea’s largest auto parts maker, said on Oct. 7 it will invest $25 million in a UK automotive smart display company in...

Oct 07, 2020 (Gmt+09:00)

-

Korean brokerage firms sitting on $7 bn in overseas properties yet to sell down

South Korean brokerage firms, having scooped up $20 billion worth of overseas real estate deals over the past three years, are now saddled with $7 bil...

Oct 06, 2020 (Gmt+09:00)

-

Machinery

MachineryKorea’s tractor and farm machinery maker envisions smart mobility firm

Daedong Industrial Co., South Korea’s leading tractor and farm machinery maker, aims to transform into a smart mobility company, applying a...

Sep 22, 2020 (Gmt+09:00)

Latest News

- 1 Want to look beautiful? – Here’s the 'Made In Korea' mask pack

- 2 LG Chem closes $1 bn water filter division sale to Glenwood PE

- 3 Hyundai Motor-backed Motional names AI veteran Laura Major as CEO

- 4 President Lee: Businesses at center of policy priorities for economic growth

- 5 Samsung supplies HBM3E to AMD’s new accelerators