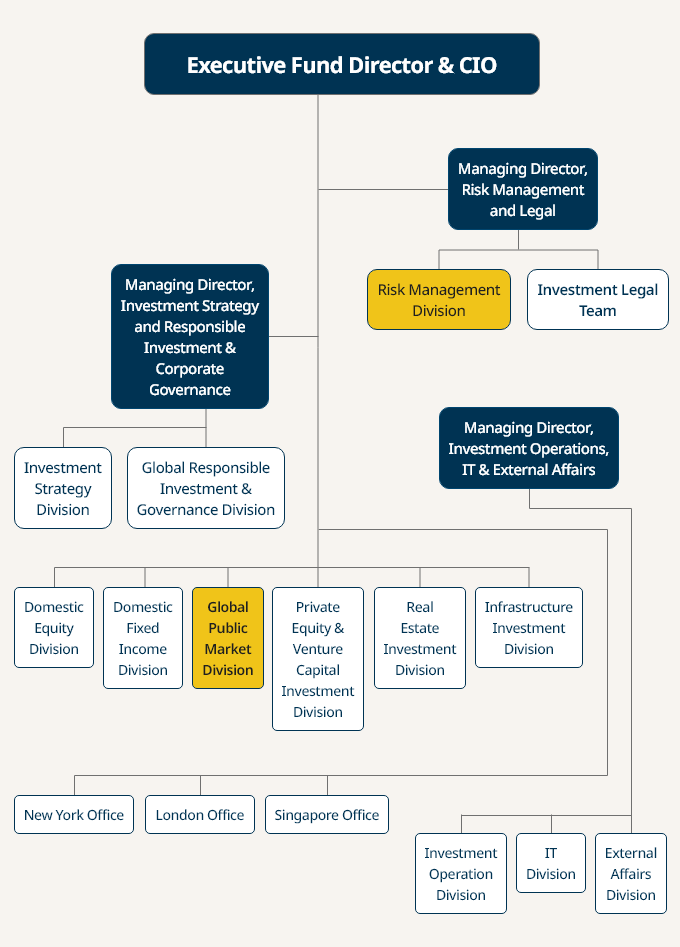

The National Pension Service has divided up its global public market division into Global Equity and Global Fixed Income divisions as part of a plan to increase the portions of overseas traditional assets this year, while boosting its direct investment.

Splitting the division into two separate groups, effective from this month, was in line with the $705 billion pension fund's

global investment plans for the 2020-2024 period, announced last August, it said on Jan. 13. The plans are aimed at reducing external management fees.

“This reorganization reflects our increasing global investments and will lay the groundwork to boost direct investment in global equities and employ flexible strategies to better respond to the changing market environment,” NPS said in a statement.

“Regarding overseas fixed income, we will expand the portions of overseas fixed-income assets and credit investments such as corporate bonds.”

Under the medium-term plan, NPS will

add 200 more employees that cover global investments by 2024, or about a fivefold increase in overseas staffing, and set up teams in its overseas offices to directly handle active investments in traditional assets.

Last year, domestic traditional assets outperformed both overseas assets and alternatives.

Domestic equities were its best-performing asset class last year with a 5.8% return as of the end of October, followed by a 2.6% return from domestic fixed income.

NPS Investment Portfolio

| Asset class |

2020 (as of end-October) |

2021 (plan) |

| Global equities |

22.3% |

25.1% |

| Global fixed income |

5.3% |

7.0% |

| Alternatives |

11.7% |

13.2% |

| Domestic equities |

18.0% |

16.8% |

| Domestic fixed income |

42.2% |

37.9% |

| Source: NPS |

To tighten risk management on alternative investments, it divided the alternative investment risk management team within the division into two sub-teams, one for private equity and the other for real assets.

Write to Chang Jae Yoo at

yoocool@hankyung.comYeonhee Kim edited this article.