North Asia private equity

Scope

Date

~

-

Beauty & Cosmetics

Beauty & CosmeticsAmorepacific, Shopee ink partnership for Southeast Asian market

Amorepacific Corp., the South Korean beauty giant, has signed a partnership agreement with Shopee, a Singaporean e-commerce platform, to expand it...

Feb 16, 2021 (Gmt+09:00)

-

Alternative investments

Alternative investmentsKKR’s Asia real estate fund draws around $400 mn from Korea

South Korean institutional investors, including the National Pension Service, have committed around $400 million to KKR’s Asia real estate f...

Jan 14, 2021 (Gmt+09:00)

-

Pension funds

Pension fundsNPS divides global securities division into equity, fixed income

The National Pension Service has divided up its global public market division into Global Equity and Global Fixed Income divisions as part of a plan...

Jan 13, 2021 (Gmt+09:00)

-

Alternative investments

Alternative investmentsKKR’s $3.9 bn Asia infra fund raises $130 mn from Korea

The Korean Teachers’ Credit Union (KTCU) and financial services firms in South Korea have committed $130 million to KKR & Co.’s inau...

Jan 11, 2021 (Gmt+09:00)

-

Private equity

Private equityCVC, TPG and Affinity Equity in bidding for JobKorea

CVC Capital Partners, TPG Capital and Affinity Equity Partners are among 10 preliminary bidders for the entire stake of South Korea’s largest ...

Dec 14, 2020 (Gmt+09:00)

-

Venture Capital

Venture CapitalKDB backs $100 mn SE Asia fund of Korean, Chinese VC firms

South Korean venture capital firm SV Investment Corp, together with China’s Shenzhen Capital Group, will raise $100 million in the Korean VC's...

Dec 09, 2020 (Gmt+09:00)

-

Mergers & Acquisitions

Mergers & AcquisitionsIMM Private Equity to set up operation-focused unit

This is the first in our bi-weekly Deal briefs series, covering the latest M&A deals and key events in South Korea’s capital markets. We w...

Dec 01, 2020 (Gmt+09:00)

-

Korean startups

Korean startupsNaver, Mirae Asset bolster presence in Southeast Asia via $898 mn fund

South Korea’s platform giant Naver Corp., alongside Mirae Asset Daewoo Co., has been increasing investments into promising startups in Southeast...

Nov 19, 2020 (Gmt+09:00)

-

Korean Investors

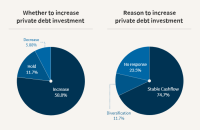

Korean InvestorsKorean LPs favor direct lending for private debt investment

More than half of South Korea’s key asset owners, led by the National Pension Service, are inclined to expand overseas private debt investment i...

Nov 17, 2020 (Gmt+09:00)

-

Pre-IPOs

Pre-IPOsAnchor Equity, TPG invest $500 mn in Korean mobile banking app

Hong Kong-based Anchor Equity Partners has agreed to invest 250 billion won ($226 million) to buy new shares in South Korea’s KakaoBank, shortly...

Nov 17, 2020 (Gmt+09:00)

-

Stepstone

Stepstone[ASK2020] Private Debt: Playing Offense or Defense?

StepStone is a leading private markets firm that oversees over US$296 billion of private capital allocations, including approximately US$67 bill...

Oct 30, 2020 (Gmt+09:00)

-

Nuveen

Nuveen[ASK2020] The US middle market private credit opportunity

Nuveen, the investment management arm of TIAA, is one of the world’s largest investment managers with over US$1 trillion in AUM as of 30 Ju...

Oct 30, 2020 (Gmt+09:00)

-

Ares SSG Management

Ares SSG Management[ASK2020] Direct Lending (or Private Credit) in Asia

Ares Management Corporation (NYSE: ARES) is a leading global alternative investment manager operating integrated businesses across Credit, Privat...

Oct 30, 2020 (Gmt+09:00)

-

Park Square

Park Square[ASK2020] The Opportunity in European Private Debt

Park Square Capital is one of the world’s most established private debt firms, providing flexible financing solutions to high-quality and ...

Oct 28, 2020 (Gmt+09:00)

-

IFM Investors

IFM Investors[ASK2020] Introduction to Australia’s Private Debt Market

IFM Investors was established more than 25 years ago with the aim to protect and grow the retirement savings of pension fund members. IFM manage...

Oct 28, 2020 (Gmt+09:00)

-

Tikehau Capital

Tikehau Capital[ASK2020] Trends in European Private Debt and Private Equity Post Covid19

Tikehau Capital is an asset management and investment group with €25.7 billion of assets under management and shareholder equity of €2...

Oct 28, 2020 (Gmt+09:00)

-

Korean investors' survey

Korean investors' surveyKorean investors pick private debt as preferred asset class

South Korea’s institutional investors, including pension funds, mutual aid associations and insurers, plan to increase the private debt portion ...

Oct 27, 2020 (Gmt+09:00)

-

Supply permit

Supply permitSamsung Display, Asia's first to win Huawei supply permit

Samsung Display Co., a leading South Korean display panel maker, has received a permit from the US to supply certain panels to Huawei Technologies Co....

Oct 27, 2020 (Gmt+09:00)

-

Infrastructure fund

Infrastructure fundKKR’s $3 bn Asia infra fund to raise $200 mn from Korea

South Korean pension funds and insurance companies will commit $200 million in aggregate to KKR’s first Asia infrastructure fund targeting to ra...

Oct 27, 2020 (Gmt+09:00)

-

Interview

InterviewKorean police fund raises risk appetite for private debt

South Korea’s Police Mutual Aid Association (PMAA) has recently selected an opportunistic strategy fund for private debt investment as the $3 bi...

Oct 27, 2020 (Gmt+09:00)

-

Michael Breen on Korean Peninsula

Michael Breen on Korean PeninsulaWhy a Biden presidency means more of the same with North Korea

If the Democratic Party candidate Joe Biden wins the US presidential election next month, as the polls suggest he will, many things will change. The g...

Oct 13, 2020 (Gmt+09:00)

-

Pension funds

Pension funds[Q&A] KTCU sees handsome returns from equities, M&A funding

The following is the full transcript of The Korea Economic Daily's interview with Korean Teachers’ Credit Union’s (KTCU) Chief Investment ...

Oct 13, 2020 (Gmt+09:00)

-

Interview

InterviewKorean teachers’ fund keen on equities, M&A deals

The Korean Teachers’ Credit Union (KTCU), a $29 billion savings fund, will increase its exposure to equities markets and M&A financing deals...

Oct 13, 2020 (Gmt+09:00)

-

Venture capital

Venture capitalKB Investment bulks up VC funds as parent group drives SE Asia expansion

KB Investment Co., the venture capital arm of South Korea’s KB Financial Group, is raising 100 billion won ($86 million) in a fund to invest in ...

Sep 21, 2020 (Gmt+09:00)

-

Pension fund

Pension fundKorean pensions sell off net $2.6 bn in domestic equities since August

South Korea’s pension funds including the National Pension Service sold off a net 3.12 trillion won ($2.6 billion) worth of domestic equities fr...

Sep 15, 2020 (Gmt+09:00)

-

Rights offering

Rights offeringAffinity Equity, Baring PEA tipped to invest $1 bn in Shinhan Financial

Affinity Equity Partners and Baring Private Equity Asia will likely invest a combined 1.2 trillion won ($1 billion) in new shares of Shinhan Financial...

Sep 04, 2020 (Gmt+09:00)

-

Korean Air

Korean AirKorean Air seals $835 mn in-flight business sale to private equity firm

Korean Air Lines Co. Ltd. signed a definitive agreement on August 25 to sell its in-flight duty-free and meal service business to South Korea’s ...

Aug 25, 2020 (Gmt+09:00)

-

Private equity

Private equityHanwha Life commits $400 mn to KKR’s new Asia buyout fund

Hanwha Life Insurance Co. Ltd., South Korea’s second-biggest life insurer, has committed around $400 million to KKR & Co.’s new Asia b...

Aug 25, 2020 (Gmt+09:00)

-

Ardian

ArdianArdian looking to expand Asia private equity investment

Paris-based Ardian is looking to increase private equity investments in Asia, setting its sight on technology, media, online service and healthcare se...

Jul 15, 2020 (Gmt+09:00)

-

Private equity

Private equityKIC forms $400 mn joint venture with NongHyup for private equity co-investment

Korea Investment Corporation (KIC) has announced a $400 million joint venture with NongHyup, or the National Agricultural Cooperative Federation, to...

Jul 13, 2020 (Gmt+09:00)

Latest News

- 1 MBK-invested Homeplus looks for new owner as M&A emerges as option

- 2 Hyundai Steel to displace Baoshan as GM Korea's supplier

- 3 S.Korea’s No.1 dried seaweed firm Kwangcheonkim up for sale for $295 mn

- 4 BOK chief warns against aggressive policy rate cuts, sees need for fiscal stimulus

- 5 S.Korea eases path for foreign REITs in senior housing push